Introduction

Behind every drilling rig, refinery, petrochemical complex, and gas processing plant lies an invisible but indispensable backbone: industrial gases. While hydrocarbons dominate the conversation in oil and gas operations, industrial gases quietly enable critical processes such as drilling, refining, welding, corrosion prevention, enhanced recovery, safety management, and equipment maintenance.

Industrial gas manufacturing plays a vital role in ensuring that oil and gas operations remain efficient, safe, and economically viable. From oxygen and nitrogen to hydrogen, carbon dioxide, and specialty gas blends, these gases are engineered, purified, stored, and delivered under strict quality and safety standards. As the global energy sector evolves toward deeper wells, higher pressures, complex reservoirs, and tighter environmental regulations, the demand for reliable industrial gas supply has grown significantly.

This blog explores how industrial gas manufacturing supports oil and gas operations, the key gases involved, and the structural role industrial gas producers play in upstream, midstream, and downstream activities. It also sets the stage for understanding emerging trends, operational challenges, and future opportunities within this essential segment of the energy value chain.

What Is Industrial Gas Manufacturing?

Industrial gas manufacturing refers to the large-scale production, purification, and distribution of gases used across industrial sectors, including oil and gas, petrochemicals, power generation, metals, and manufacturing. Unlike atmospheric air, industrial gases are processed to meet highly specific purity, pressure, and compositional requirements.

These gases are typically classified into three main categories:

Atmospheric gases, such as oxygen, nitrogen, and argon, extracted from air through separation technologies.

Process gases, including hydrogen, carbon dioxide, and synthesis gas, produced through chemical reactions and reforming processes.

Specialty and application-specific gases, tailored blends used for drilling, stimulation, inerting, safety systems, and chemical processing.

In oil and gas operations, even minor variations in gas purity or supply reliability can impact safety, production efficiency, and asset integrity. This makes industrial gas manufacturing a precision-driven discipline, closely aligned with operational requirements in the energy sector.

Why Industrial Gases Are Critical to Oil & Gas Operations

Oil and gas activities operate under extreme conditions — high pressure, high temperature, corrosive environments, and flammable atmospheres. Industrial gases help operators manage these challenges by enabling both routine and specialized processes.

Nitrogen, for example, is widely used for inerting pipelines, purging vessels, pressure testing, and well stimulation. Its non-reactive nature makes it essential for maintaining safe environments during maintenance or shutdown operations. Oxygen, while reactive, plays a critical role in refining, wastewater treatment, and controlled oxidation processes. Hydrogen is central to hydrocracking, hydrotreating, and desulfurization processes in refineries, helping produce cleaner fuels that meet environmental standards.

Carbon dioxide finds applications in enhanced oil recovery (EOR), where it is injected into reservoirs to improve hydrocarbon flow and increase recovery rates. Specialty gases and gas mixtures support welding, cutting, leak detection, and corrosion control, ensuring mechanical integrity across pipelines, storage tanks, and processing equipment.

Without a stable and high-quality industrial gas supply, many oil and gas operations would face increased downtime, safety risks, and operational inefficiencies.

Industrial Gas Manufacturing Methods Used for Energy Applications

Industrial gas production relies on advanced technologies designed to deliver consistent quality at scale. For oil and gas use, manufacturing methods must meet stringent reliability and purity standards.

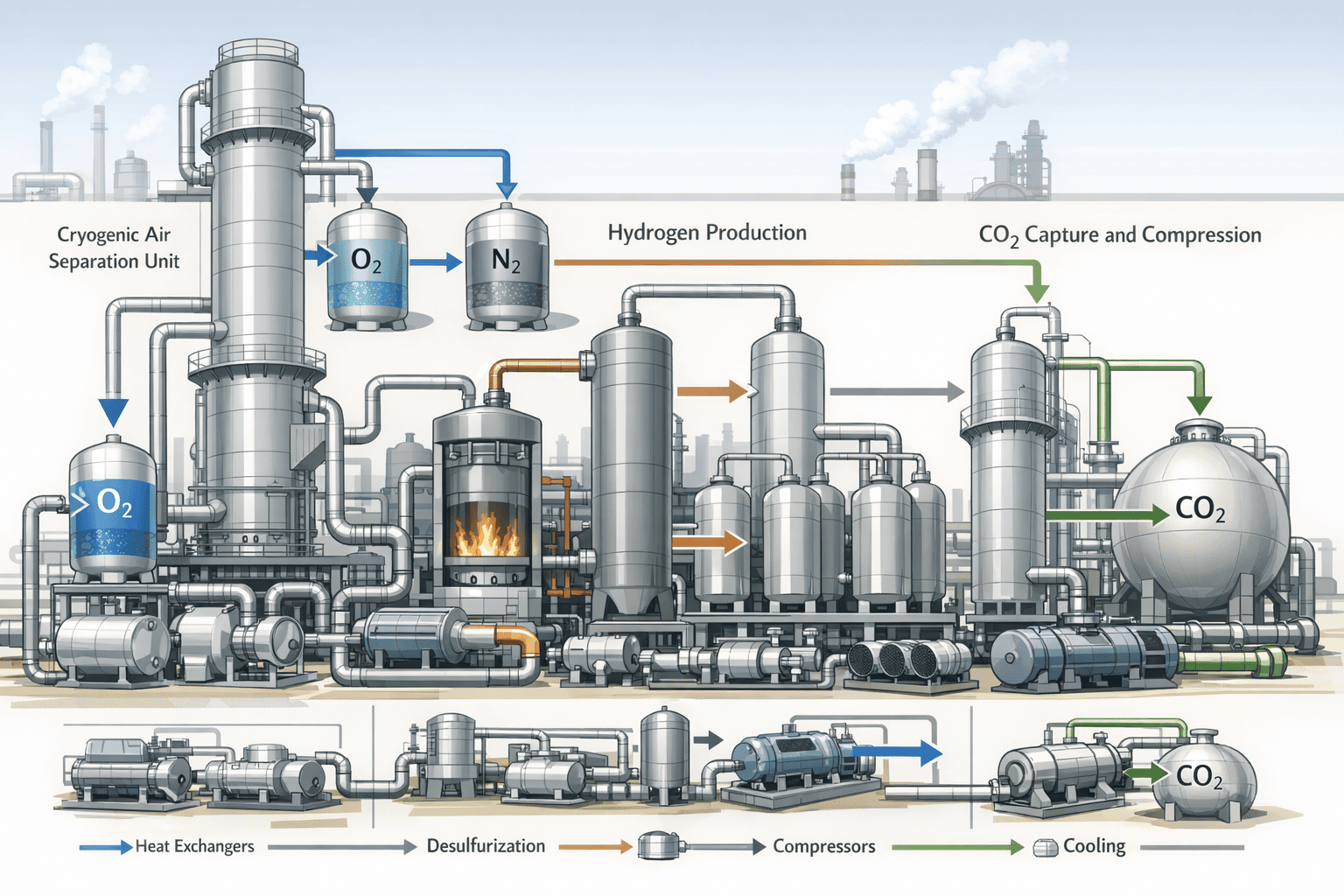

One of the most widely used technologies is air separation, which isolates oxygen, nitrogen, and argon from atmospheric air. This process is typically carried out using cryogenic distillation or, in smaller-scale applications, pressure swing adsorption (PSA) and membrane separation systems. These technologies allow gas producers to supply different purity grades based on operational needs.

Hydrogen manufacturing is another cornerstone of industrial gas production for the energy sector. It is commonly produced through steam methane reforming (SMR), partial oxidation, or autothermal reforming. These methods convert hydrocarbons into hydrogen-rich gas streams that are later purified. Hydrogen supply is especially critical for refineries processing heavy or sour crude.

Carbon dioxide production often involves capturing CO₂ from industrial processes such as ammonia production or natural gas processing. The captured gas is then purified, compressed, and stored for applications like EOR or inerting.

Each of these manufacturing methods requires careful integration with storage, compression, and logistics systems to ensure uninterrupted supply to oil and gas facilities.

Supply Chain Importance: From Manufacturing to Field Delivery

Industrial gas manufacturing does not end at production. Storage, transportation, and on-site delivery are equally important, especially in oil and gas environments where operations may be remote or offshore.

Gases may be delivered in compressed cylinders, cryogenic liquid tanks, or via on-site generation systems, depending on consumption volume and operational constraints. Offshore platforms, drilling rigs, and remote production sites often rely on mobile gas supply systems that must withstand harsh environmental conditions.

Any disruption in gas supply — whether due to logistics delays, equipment failure, or safety incidents — can halt operations entirely. As a result, oil and gas companies increasingly seek reliable industrial gas partners who can offer not just products, but integrated supply-chain solutions.

Setting the Stage for Trends, Challenges, and Opportunities

As oil and gas projects move into deeper waters, unconventional reservoirs, and stricter regulatory environments, the role of industrial gas manufacturing continues to expand. The industry now faces new demands related to sustainability, carbon management, cost optimization, and operational flexibility.

In the next sections of this blog, we will explore:

Emerging trends shaping industrial gas manufacturing for oil and gas

Key challenges faced by producers and end-users

Strategic opportunities for suppliers and solution providers

Nitrogen: The Backbone of Safety, Inerting, and Pressure Control

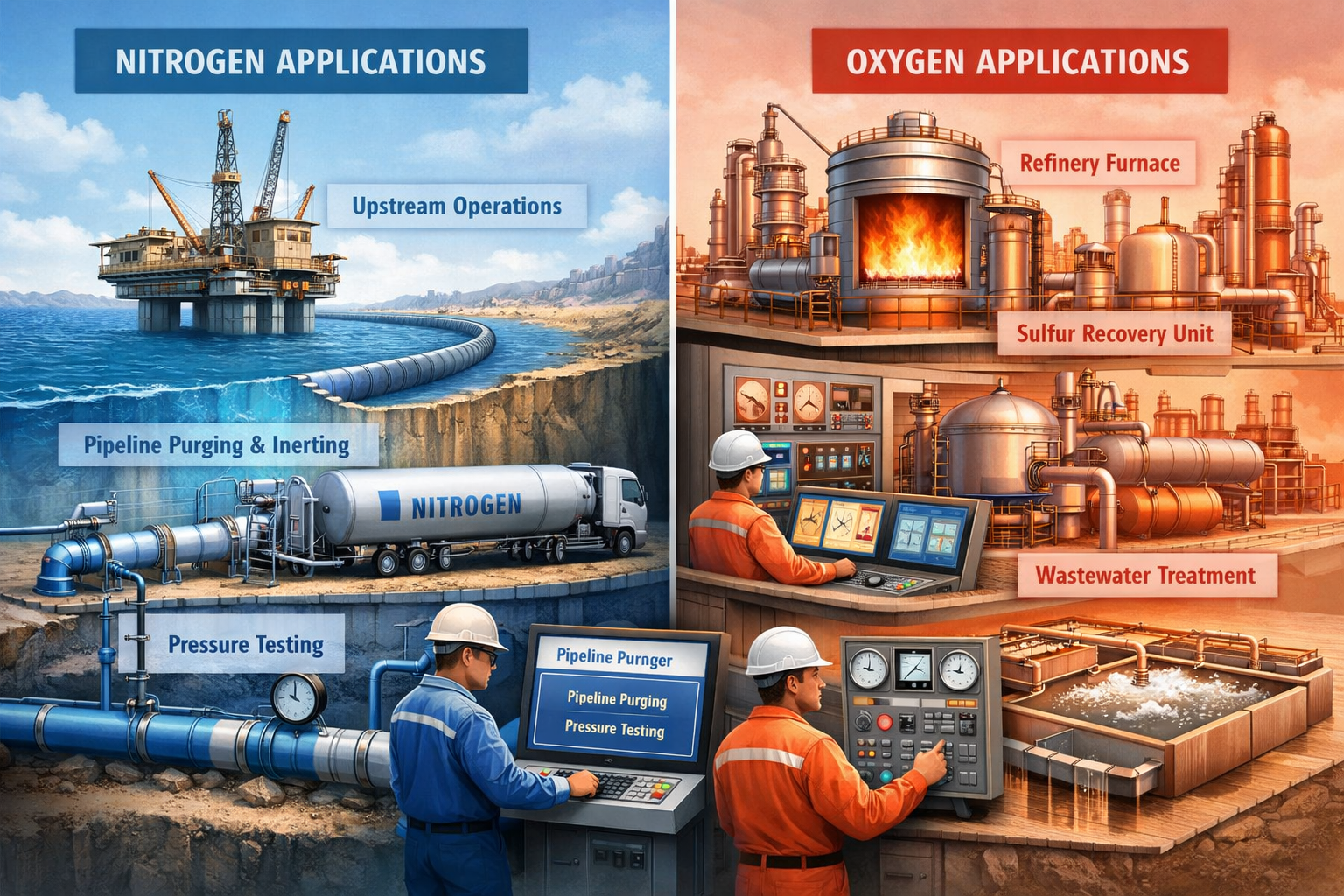

Nitrogen is one of the most widely used industrial gases in oil and gas operations due to its inert and non-flammable nature. Its primary value lies in its ability to displace oxygen and moisture, creating safer operating environments.

In upstream drilling and well services, nitrogen is commonly used for well stimulation, well cleanup, and pressure testing. Nitrogen-assisted lifting helps remove fluids from wells without introducing reactive gases, improving flow efficiency while minimizing formation damage.

During maintenance and shutdown activities, nitrogen is used extensively for pipeline purging and inerting. By removing oxygen from pipelines, storage tanks, and vessels, operators significantly reduce the risk of fire, explosion, and corrosion. This is especially critical during hot work, equipment replacement, or commissioning of new assets.

Midstream and downstream facilities rely on nitrogen for blanketing storage tanks, preventing oxidation of hydrocarbons and protecting product quality. Nitrogen is also used in leak detection, pressure testing, and controlled pressurization of pipelines.

Because of its broad application range, nitrogen manufacturing and supply must be highly reliable, with purity levels tailored to the specific operational use.

Oxygen: A Controlled Catalyst in Refining and Processing

While oxygen is highly reactive, its controlled use is essential in downstream oil and gas operations. In refineries and petrochemical plants, oxygen supports oxidation reactions, wastewater treatment processes, and sulfur recovery units.

Oxygen enrichment enhances combustion efficiency in furnaces and boilers, leading to better fuel utilization and reduced emissions. In wastewater treatment units attached to refineries and gas processing plants, oxygen promotes aerobic biological activity, improving effluent treatment efficiency and compliance with environmental standards.

Due to the risks associated with oxygen handling, its manufacturing, storage, and delivery require stringent safety protocols. Industrial gas suppliers must ensure precise purity control and safe distribution systems to prevent uncontrolled reactions.

Hydrogen: The Engine of Modern Refining

Hydrogen plays a central role in refining operations, particularly as global fuel standards continue to tighten. Modern refineries rely heavily on hydrogen for hydrotreating and hydrocracking, processes that remove sulfur, nitrogen, and other impurities from crude oil fractions.

Hydrogen enables the conversion of heavy hydrocarbons into lighter, cleaner fuels such as diesel and gasoline. It is also essential for processing sour crudes, which contain higher sulfur content and require extensive treatment to meet regulatory specifications.

Industrial hydrogen manufacturing typically involves reforming hydrocarbon feedstocks, followed by purification to achieve the required quality. Any disruption in hydrogen supply can directly affect refinery throughput, making supply continuity a top priority for downstream operators.

Carbon Dioxide: From Waste Gas to Production Enhancer

Carbon dioxide has evolved from a byproduct into a valuable industrial gas for oil and gas applications. One of its most significant uses is in enhanced oil recovery (EOR), where CO₂ is injected into reservoirs to increase oil mobility and improve recovery rates.

When injected under controlled conditions, carbon dioxide reduces oil viscosity and helps push hydrocarbons toward production wells. This technique has proven particularly effective in mature fields where conventional recovery methods are no longer economically viable.

Beyond EOR, carbon dioxide is used for inerting, purging, and fire suppression systems. With growing emphasis on carbon capture and utilization, CO₂ manufacturing and recycling are becoming increasingly integrated into energy operations.

Helium and Specialty Gases: Precision Applications

Although used in smaller volumes, specialty gases such as helium play critical roles in oil and gas operations. Helium is commonly used for leak detection in pipelines, pressure vessels, and critical components due to its small atomic size and inert nature.

Special gas blends support welding, cutting, and analytical applications where precision and reliability are essential. These gases are manufactured to exact specifications, often customized for specific field or facility requirements.

Role of Industrial Gases Across the Oil & Gas Value Chain

Industrial gas usage spans every stage of the oil and gas lifecycle:

Upstream: drilling, stimulation, well testing, safety systems, and pressure control

Midstream: pipeline maintenance, storage protection, inerting, and leak detection

Downstream: refining, processing, emission control, wastewater treatment, and fuel upgrading

This wide applicability underscores why industrial gas manufacturing is not just a support service but a strategic component of energy operations.

Why Reliable Gas Manufacturing Matters

The performance of industrial gases depends not only on chemical composition but also on supply reliability, purity consistency, and logistical efficiency. Any deviation can compromise safety, damage equipment, or reduce production efficiency.

As oil and gas operations become more complex and geographically dispersed, industrial gas manufacturers must adapt by offering flexible supply models, on-site generation options, and robust logistics support.

Growing Demand from Complex and Harsh Operating Environments

One of the most significant trends influencing industrial gas manufacturing is the shift toward deeper, hotter, and more technically challenging oil and gas projects. As conventional reserves decline, operators are increasingly investing in deepwater, ultra-deepwater, high-pressure high-temperature (HPHT), and unconventional reservoirs.

These environments place greater demands on industrial gases. Nitrogen systems must handle higher pressures, hydrogen must meet stricter purity requirements for advanced refining processes, and specialty gases must perform reliably in extreme temperatures. This has pushed gas manufacturers to improve process control, enhance quality assurance, and invest in advanced production technologies.

On-Site Gas Generation and Decentralized Supply Models

Traditionally, industrial gases were produced at centralized plants and transported to oil and gas facilities. While this model still exists, there is a clear shift toward on-site and near-site gas generation, especially for nitrogen and oxygen.

On-site nitrogen generation units are increasingly used at drilling sites, refineries, and pipeline facilities to ensure uninterrupted supply and reduce dependency on transportation logistics. This trend is driven by the need for operational continuity, cost optimization, and safety improvement, particularly in remote or offshore locations.

However, deploying on-site systems introduces challenges related to equipment maintenance, energy consumption, and skilled workforce availability, which manufacturers and service providers must address through training and digital monitoring solutions.

Hydrogen Demand and the Push for Cleaner Fuels

Hydrogen demand is rising rapidly as refineries adapt to stricter fuel quality regulations and emission standards. Low-sulfur fuels, cleaner gasoline, and advanced petrochemical feedstocks all require hydrogen-intensive processes.

This trend has placed pressure on hydrogen manufacturing capacity, forcing suppliers to explore more efficient production routes and purification technologies. At the same time, the oil and gas sector is beginning to explore low-carbon hydrogen options, including blue hydrogen (with carbon capture) and green hydrogen (produced using renewable energy).

Balancing conventional hydrogen supply needs with long-term decarbonization goals is emerging as one of the most complex challenges for industrial gas manufacturers.

Sustainability and Environmental Compliance Pressures

Environmental regulations are becoming stricter across the globe, affecting both oil and gas operators and their supporting industries. Industrial gas manufacturing is energy-intensive, and its carbon footprint is increasingly under scrutiny.

Manufacturers are under pressure to:

Reduce emissions from gas production units

Improve energy efficiency of compressors and separation systems

Integrate carbon capture and utilization technologies

Minimize gas losses during storage and transport

At the same time, oil and gas companies expect gas suppliers to help them meet sustainability targets through cleaner processes and lower-emission solutions. This dual responsibility adds complexity to operational planning and capital investment decisions.

Safety Expectations and Risk Management

Safety has always been a critical concern in industrial gas manufacturing, but expectations continue to rise as operations scale and regulations tighten. Handling gases such as hydrogen, oxygen, and high-pressure nitrogen requires strict adherence to safety standards, continuous monitoring, and robust emergency response systems.

Any incident involving industrial gases can have severe consequences, including production downtime, asset damage, and reputational risk. As a result, gas manufacturers are investing heavily in automation, real-time monitoring, and predictive maintenance technologies to reduce operational risks.

Supply Chain Volatility and Logistics Challenges

Industrial gas supply chains are highly sensitive to disruptions. Oil and gas operations often depend on uninterrupted gas availability, especially during critical phases such as drilling, maintenance shutdowns, or refinery turnarounds.

Challenges such as fluctuating energy prices, transportation constraints, geopolitical uncertainties, and infrastructure limitations can impact gas availability. Manufacturers must therefore build resilient supply chains, maintain buffer capacities, and offer flexible delivery models to meet client expectations.

Digitalization and Smart Manufacturing

Digital transformation is increasingly shaping industrial gas manufacturing. Advanced analytics, automation, and remote monitoring systems are being deployed to improve plant efficiency, predict equipment failures, and optimize energy usage.

For oil and gas clients, digital integration enables better coordination between gas supply systems and operational processes. This trend supports higher uptime, improved safety, and more transparent performance metrics across the value chain.

The Strategic Shift in Industrial Gas Partnerships

Perhaps the most important trend is the shift in how oil and gas companies view industrial gas suppliers. Instead of transactional vendors, suppliers are increasingly expected to act as long-term strategic partners who understand operational challenges, regulatory requirements, and sustainability goals.

This requires gas manufacturers to offer not only products but also technical expertise, engineering support, and customized solutions aligned with specific field or facility needs.

Integrated Gas Supply and Chemical Solutions

Oil and gas operators are increasingly seeking integrated solutions rather than sourcing gases, chemicals, and logistics from multiple vendors. Industrial gas manufacturers that can bundle supply with engineering support, safety systems, and operational consulting gain a competitive edge.

This integration reduces complexity for operators while improving reliability and cost efficiency across projects. It also strengthens long-term partnerships between gas suppliers and energy companies.

Growth of Low-Carbon and Cleaner Gas Technologies

The global energy transition is influencing even traditional oil and gas operations. Hydrogen is becoming more important not only for refining but also as a bridge fuel toward cleaner energy systems. Similarly, nitrogen is being used more extensively in emissions control, inerting, and safety-driven applications.

Industrial gas manufacturers that invest in energy-efficient production technologies, carbon capture integration, and low-emission gas systems will be better positioned to support both current oil and gas operations and future energy infrastructure.

Digitalization as a Competitive Advantage

The future of industrial gas manufacturing will be increasingly data-driven. Predictive maintenance, automated process control, real-time quality monitoring, and digital reporting are becoming essential capabilities.

For oil and gas clients, digital integration means better visibility into gas usage, improved safety oversight, and optimized consumption. Manufacturers that embrace smart manufacturing technologies can deliver measurable performance improvements and long-term value.

Future Outlook: Where the Industry Is Headed

Looking ahead, industrial gas manufacturing for the oil and gas sector will be shaped by three defining forces:

Operational complexity – demanding higher purity, reliability, and customization

Regulatory and environmental pressure – pushing cleaner, safer, and more efficient gas solutions

Strategic partnerships – favoring suppliers who offer technical expertise and end-to-end support

Rather than declining alongside traditional energy narratives, industrial gas manufacturing is expected to remain resilient and adaptive, supporting both conventional hydrocarbon operations and emerging energy systems.

Conclusion: Industrial Gases as a Cornerstone of Energy Operations

Industrial gas manufacturing plays a foundational role in the oil and gas industry—supporting drilling, production, refining, maintenance, and safety at every stage of the value chain. From nitrogen used in pressure control and inerting to hydrogen powering cleaner refining processes, these gases enable efficiency, reliability, and operational continuity.

As the energy sector faces deeper reservoirs, stricter regulations, and higher performance expectations, the importance of trusted, technically capable industrial gas suppliers will only increase. Manufacturers that combine production excellence with innovation, safety, and sustainability will continue to be indispensable partners in the evolving oil and gas landscape.

For energy companies, choosing the right industrial gas partner is no longer just a procurement decision—it is a strategic investment in long-term performance and resilience.

Frequently Asked Questions (FAQs)

1. Why are industrial gases essential to oil and gas operations?

Industrial gases support critical processes such as drilling pressure control, reservoir stimulation, refining reactions, inerting, and safety systems. Without reliable gas supply, many oil and gas operations cannot function efficiently or safely.

2. Which industrial gases are most commonly used in the oil and gas industry?

Nitrogen and hydrogen are the most widely used, followed by oxygen, carbon dioxide, and specialty gases. Each serves distinct roles across upstream, midstream, and downstream operations.

3. How does on-site gas generation benefit oil and gas facilities?

On-site generation improves supply reliability, reduces logistics dependency, enhances safety, and can lower long-term operational costs—especially in remote or offshore locations.

4. What challenges do industrial gas manufacturers face today?

Key challenges include rising energy costs, stricter environmental regulations, safety requirements, supply chain disruptions, and the need to support increasingly complex oil and gas projects.

5. How is sustainability influencing industrial gas manufacturing?

Manufacturers are investing in energy-efficient systems, emission reduction technologies, and cleaner gas solutions to align with environmental regulations and oil and gas sustainability goals.